What Is Capital Recovery Allowance . capital recovery is the process of regaining the initial investment made in a business or project. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time.

from calrecovery.org

the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital recovery is the process of regaining the initial investment made in a business or project. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and.

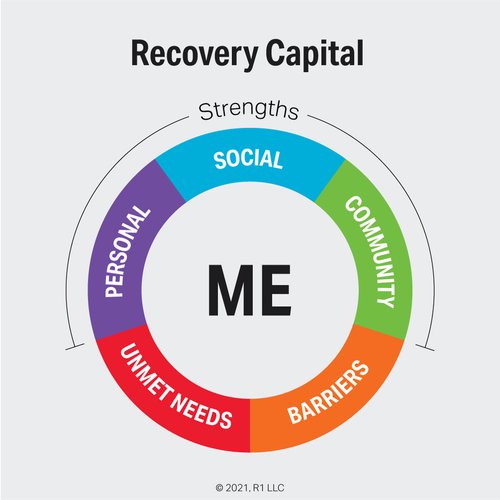

5 Dimensions of Recovery Capital Do You Know the Basics? Addiction

What Is Capital Recovery Allowance learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. capital recovery is the process of regaining the initial investment made in a business or project. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and.

From chacc.co.uk

Brief Guide to Capital Allowances Clear House Accountants What Is Capital Recovery Allowance capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. capital recovery is the process of regaining the initial investment made in a business or project. learn how capital allowances, or. What Is Capital Recovery Allowance.

From taxfoundation.org

Capital Allowances Capital Cost Recovery across the OECD What Is Capital Recovery Allowance learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. . What Is Capital Recovery Allowance.

From www.moneytaskforce.com

What Are Capital Allowances? Understanding the Basics What Is Capital Recovery Allowance learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. capital recovery is the process of regaining the initial investment. What Is Capital Recovery Allowance.

From taxfoundation.org

Capital Cost Recovery across the OECD, 2019 Capital Recovery What Is Capital Recovery Allowance capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital recovery is the process of regaining the initial investment. What Is Capital Recovery Allowance.

From www.accountsportal.com

Changes To UK Capital Allowances in 2019 How Your Business Can What Is Capital Recovery Allowance capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. capital recovery is the process of regaining the initial investment made in a business or project. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. learn how capital allowances, or depreciation,. What Is Capital Recovery Allowance.

From americanlegaljournal.com

Capital Allowances Capital Cost Recovery Across The OECD, 2023 What Is Capital Recovery Allowance capital recovery is the process of regaining the initial investment made in a business or project. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. capital allowances and deductions can reduce. What Is Capital Recovery Allowance.

From taxfoundation.org

Capital Allowances Capital Cost Recovery, 2021 Tax Foundation What Is Capital Recovery Allowance capital recovery is the process of regaining the initial investment made in a business or project. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. learn how to. What Is Capital Recovery Allowance.

From www.slideserve.com

PPT Annual Worth Analysis PowerPoint Presentation, free download ID What Is Capital Recovery Allowance capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. capital recovery is the process of regaining the initial investment made in a business or project. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. learn how to depreciate capital expenditures for. What Is Capital Recovery Allowance.

From accgroup.vn

What is capital recovery? What Is Capital Recovery Allowance capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and. capital recovery is the process of regaining the initial investment made in a business or project. capital allowances can be expressed as a percentage of the net present value of investment costs that businesses. learn how to depreciate capital expenditures for tax purposes,. What Is Capital Recovery Allowance.

From taxfoundation.org

Capital Allowances Capital Cost Recovery across the OECD, 2023 What Is Capital Recovery Allowance capital recovery is the process of regaining the initial investment made in a business or project. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital allowances and. What Is Capital Recovery Allowance.

From www.accountingfirms.co.uk

Guide About What is Capital Allowance? AccountingFirms What Is Capital Recovery Allowance learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. capital recovery is the process of regaining the initial investment made in a business or project. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital allowances and deductions can reduce taxable income, effectively. What Is Capital Recovery Allowance.

From www.linkedin.com

Types of Capital Allowances & Their Regulation What Is Capital Recovery Allowance the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital recovery is the process of regaining the initial investment made in a business or project. capital allowances and. What Is Capital Recovery Allowance.

From taxfoundation.org

Capital Allowances Capital Cost Recovery across the OECD, 2023 What Is Capital Recovery Allowance capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. the modified accelerated cost recovery system (macrs) allows a business to recover. What Is Capital Recovery Allowance.

From jungkookq.blogspot.com

Initial Allowance And Annual Allowance Capital Cost Recovery Capital What Is Capital Recovery Allowance capital recovery is the process of regaining the initial investment made in a business or project. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. capital allowances can. What Is Capital Recovery Allowance.

From theadvisermagazine.com

Capital Allowances Capital Cost Recovery across the OECD, 2024 What Is Capital Recovery Allowance learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital recovery is the process of regaining the initial investment made in a business or project. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. capital allowances can be expressed as a percentage of. What Is Capital Recovery Allowance.

From socialwork.buffalo.edu

Multidimensional Inventory of Recovery Capital University at Buffalo What Is Capital Recovery Allowance learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. capital allowances can. What Is Capital Recovery Allowance.

From www.investopedia.com

Capital Recovery Definition, Analysis, and Uses What Is Capital Recovery Allowance the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. capital recovery is the process of regaining the initial investment made in a business or project. capital allowances and deductions can reduce taxable income, effectively lowering tax liabilities and. capital allowances can be expressed. What Is Capital Recovery Allowance.

From efinancemanagement.com

Capital Recovery Factor Meaning, Formula, Example and More What Is Capital Recovery Allowance learn how to depreciate capital expenditures for tax purposes, including section 179, special depreciation allowance, and. the modified accelerated cost recovery system (macrs) allows a business to recover the cost basis of certain assets that deteriorate over time. learn how capital allowances, or depreciation, affect business investment and economic growth in oecd countries. capital allowances can. What Is Capital Recovery Allowance.